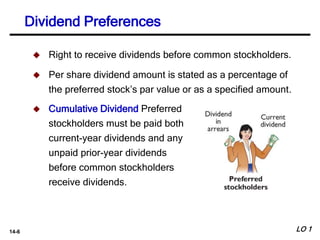

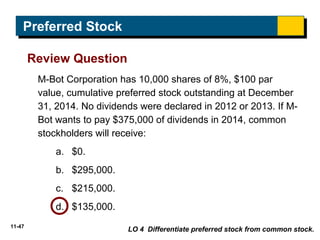

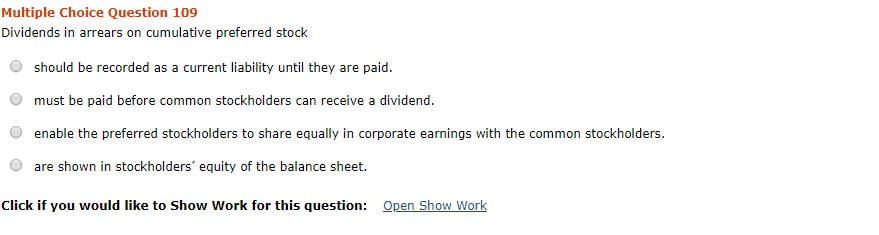

cumulative preferred stockholders have the right to receive

The preferred stockholders do not. Cumulative preferred stock shareholders are treated differently because they have the right to receive a dividend whether one is declared or not.

11 Reporting And Analyzing Stockholders Equity Ppt Download

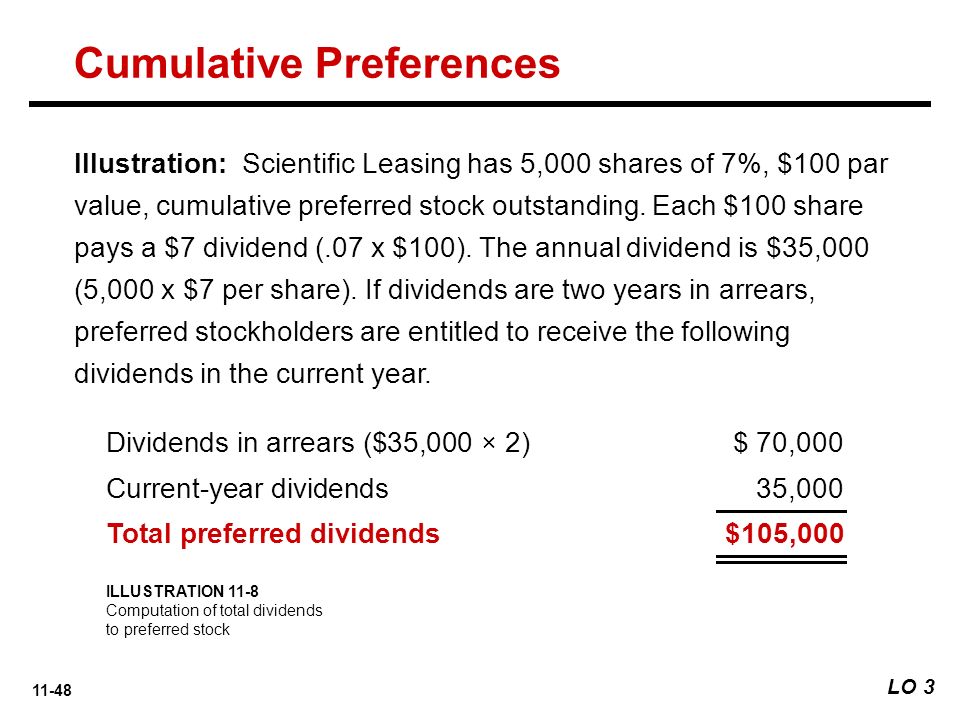

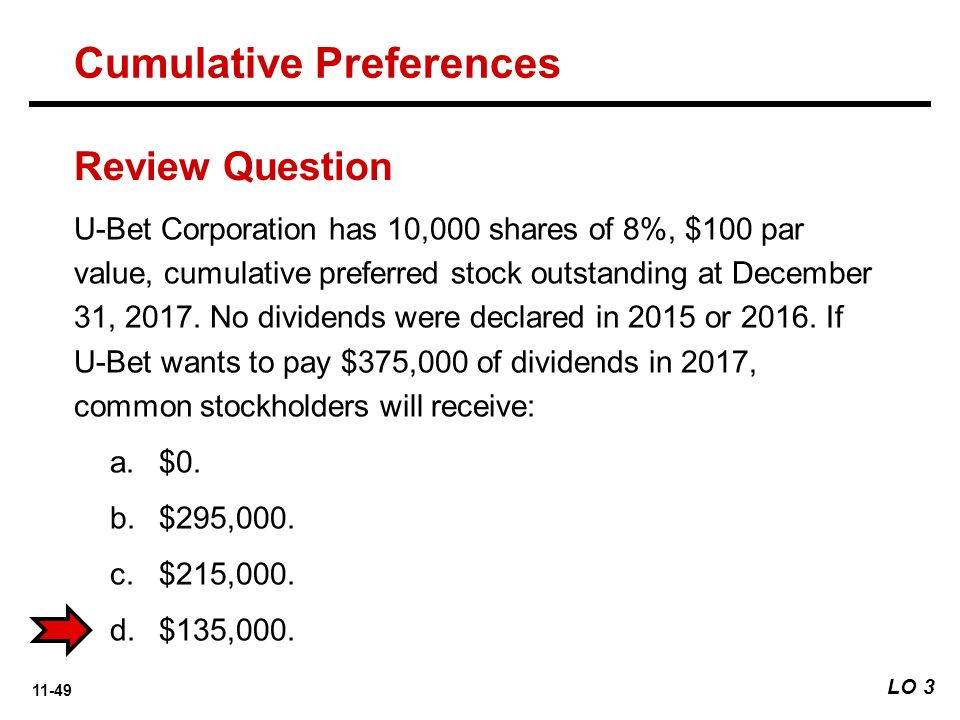

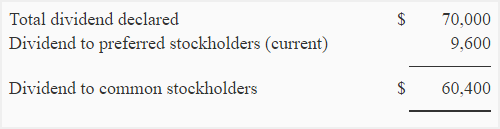

In this case the cumulative preferred stockholders must receive 900 in arrears in addition to the current dividend of 600 as of that time.

. Sell or transfer any of their shares. And the right to receive repayment of invested. Common stock provides the following rights to shareholders.

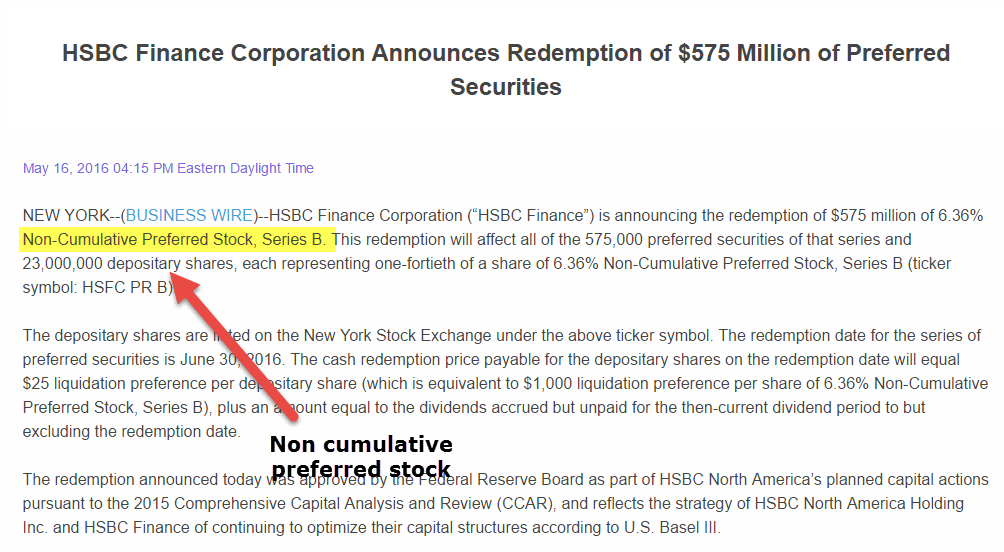

B have the right to receive dividends only if there are enough. Preferred shareholders usually have the right to receive a dividend before common shareholders. These dividends are not carried over to subsequent years.

Cumulative preferred stock is a type of preferred stock with a. The guaranteed dividend for these. The preferred stock annual dividend 3500 Preferred stock par value 1000 50 multiplied times 7.

Finance questions and answers. The cumulative preferred stock shareholders must be paid the 900 in arrears in addition to the current dividend of 600. A cumulative dividend is a required fixed distribution of earnings made to shareholders.

A have the right to receive dividends only in the years the board of directors declares dividends. Dividends in arrears after common stockholders are paid. Cumulative preferred stockholders receive a dividend that is paid to them on the same date each year.

Traditionally cumulative preferred stocks have a stated dividend yield that is based on the par value of the share. As soon as all the cumulative preferred shareholders. Preferred shares are the most common type of share class that provides the.

This dividend is payable quarterly semi-annually or annually. Common and Preferred Stock. Preferred stockholders have the right to receive dividends to strears those not paid in prior years promised prior to common stock dividends being paid.

All corporations have common stock. Cumulative preferred stockholders have the right to receive a. Participating preferred stock is a type of preferred stock that gives the holder the right to receive dividends equal to the normally specified rate that preferred.

A greater share of dividends than common stockholders.

11 Reporting And Analyzing Stockholders Equity Ppt Download

Accounting Principles 12th Edition Ch14

Preferred Stock Awesomefintech Blog

How To Calculate The Price Of Preferred Stock For A Startup Abstractops

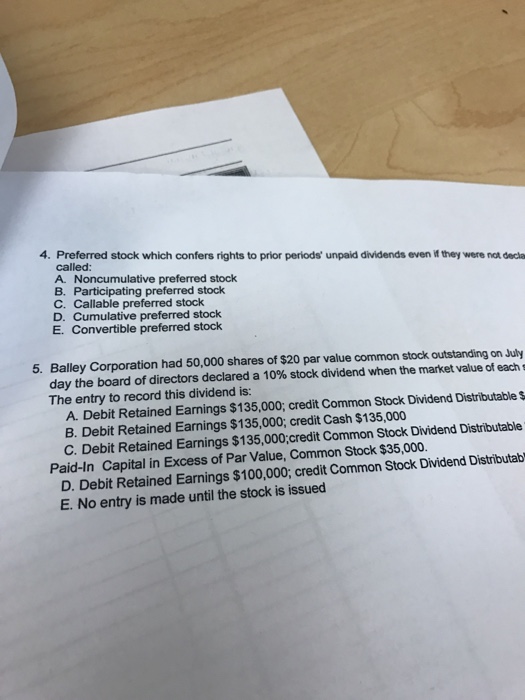

Solved Preferred Stock Which Confers Rights To Prior Chegg Com

Pdf Chapter 7 Stock Valuation Ahmed Ismail Eissa Ismail Academia Edu

What Is A Preferred Stock And How Does It Work Ramsey

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Coursecollege Com 1 23 Corporations Learning Objectives 1 Identify Characteristics Of A Corporation 2 Account For Organizing A Corporation 3 Account For Ppt Download

Acc102 Chap11 Publisher Power Point

Preferred Stock Convertible Vs Participating Returns Calculator

Equity Financing Learning Objectives Ppt Download

:max_bytes(150000):strip_icc()/book-with-page-about-preferred-stock--trading-concept--814447584-db8f837c330d4d8e9974c345d342867d.jpg)

Noncumulative Definition And Examples

Preferred Stock Awesomefintech Blog

Rules And Rights Of Common And Preferred Stock Boundless Finance Course Hero

What Happens If A Company Doesn T Pay Dividends To Stockholders

Solved Multiple Choice Question 109 Dividends In Arrears On Chegg Com